Silla Nanotechnologies stock contributing to inventive innovation companies can be one of the most energizing and fulfilling ways for financial specialists. One such company that’s been making features is Silla Nanotechnologies. With its groundbreaking headways in battery innovation, it’s capturing the consideration of numerous in the tech and venture world. But some time recently, plunging into whether. Silla Nanotechnologies stock is worth your consideration; let’s begin by investigating what the company is, its potential, and how its stock might perform in the future. In this web journal post, we’ll cover the fundamentals of Sila Nanotechnologies, its innovation, the state of its stock, and why financial specialists are observing this company. We’ll also give you supportive joins to assist in investigating this cutting-edge company and making educated venture decisions.

What is Silla Nanotechnologies?

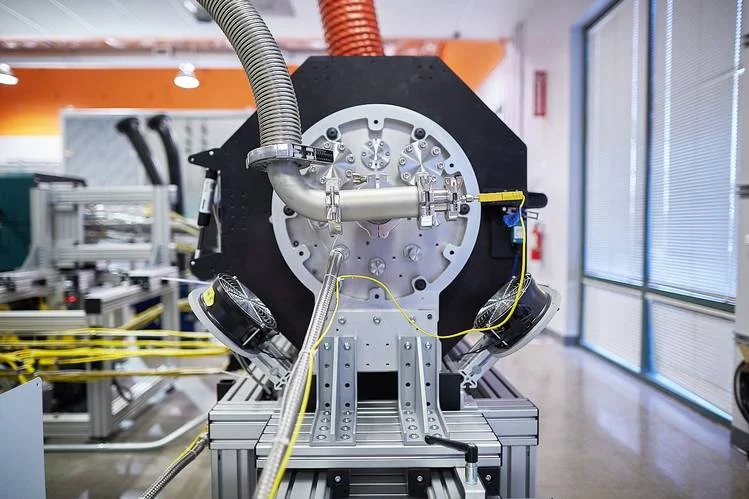

This is where Sila Nano steps in. The company has created silicon-based anode materials that guarantee to essentially make strides in the execution of lithium-ion batteries. Their innovation can increment the vitality thickness of batteries by as much as 20-40%, which implies longer-lasting control in smaller, lighter batteries. This is particularly vital for businesses like electric vehicles, where battery productivity is a key calculation in deciding extent and performance.

Why Silla Nanotechnologies Is ImportantThe innovation created by Silla Nano is pivotal because of the developing request for way better, more proficient batteries. The electric vehicle showcase is booming, and as the world moves toward clean vitality, the requirement for advanced battery innovation will grow as it develops. Sila Nano’s advancements have the potential to alter the diversion by making batteries more capable, reasonable, and reliable.

Additionally, the company has pulled in major organizations. Sila Nano has joined up with automakers like BMW and Daimler, which shows how genuinely the industry is taking its innovation. These collaborations give Sila Nano a competitive edge in the showcase, expanding its development potential. And with more businesses depending on high-performing batteries (think smartphones, wearables, rambles, etc.), the sky is the restraint for this company.

How Does Silla Nanotechnologies Stock Fit Into the Picture?

Now that we’ve built up why Silla Nanotechnologies is such a progressive company, let’s jump into the subject of its stock.

As of the time of composing this web journal post, Silla Nanotechnologies is still a privately held company. This implies that it hasn’t gone open, however, so you won’t discover it recorded on any stock trades like NASDAQ or the New York Stock Exchange (NYSE). Be that as it may, the company’s potential IPO (Starting Open Advertising) is a hot point among investors.

When Sila Nano does, in the long run, go open, it’s anticipated to draw in a parcel of consideration. Numerous speculators are keeping a keen eye on the company’s advance and associations in hopes of getting in early when the stock is at long last accessible. If Silla’s battery innovation proceeds to perform as anticipated, the company may end up one of the pioneers in the battery industry, making its stock an alluring expansion to speculation portfolios.

Will Silla Nanotechnologies Go Public?

While there hasn’t been an official declaration concerning when Silla Nanotechnologies will go open, numerous industry investigators anticipate that an IPO is likely on the skyline. Ordinarily, companies like Silla Nano, which have solid mechanical establishments and major industry organizations, in the long run, make the jump to becoming freely traded.

If and when the company chooses to go open, it will be required to meet certain necessities, record the essential printed material, and choose how many offers to offer. For financial specialists, this seems to be a colossal opportunity, particularly for those who have taken after the company from the beginning.

That being said, it’s critical to be cautious when contributing to IPOs. Frequently, the stock cost can be unstable in the early days of exchanging, as the advertiser tries to discover the right esteem for the company. Speculators ought to do their inquiry, consider their chance resistance, and think long-term when it comes to contributing to companies like Silla Nano.

What Sets Silla Nanotechnologies Apart From Competitors?

One thing that makes Silla Nanotechnologies stand out from competitors is its silicon anode innovation. Most conventional lithium-ion batteries utilize graphite in their anodes, but Sila’s utilization of silicon permits much higher vitality thickness. This can lead to smaller, lighter batteries that last longer—a gigantic advantage in businesses like electric vehicles.

Sila Nano’s approach isn’t fair to approximately hypothetical advancements either. The company has been testing its innovation in real-world applications and has appeared promising. Also, the company’s associations with major players in the car and gadgets businesses give it a leg up over smaller competitors who may not have the same level of industry support.

In an advertisement that’s rapidly becoming swarmed with new battery companies. Silla Nanotechnologies’ special approach and solid backing from major industry players make it a company worth observing closely.

Challenges and Risks

Despite all of the potential, Silla Nanotechnologies is not without its dangers. The battery industry is profoundly competitive, and Silla Nano is a promising item. There are other companies, moreover, working on next-generation battery advances. Companies like QuantumScape and Strong Control are creating solid-state batteries, which might also disturb the market.

Additionally, the move from a secretly held company to a freely exchanged one can be precarious. If Sila Nano’s IPO doesn’t go as arranged. It seems to lead to critical instability in the stock cost. And whereas the company has solid industry organizations.

How to Plan for a Silla Nanotechnologies Stock IPO

Stay Educated: Keep an eye on news related to Silla Nanotechnologies and its potential IPO. Take after money-related news locales and set up alarms for any declarations the company makes.

Research IPOs: If you’re unused to contributing to IPOs, take the time to learn how they work. IPO stock can be unstable, and understanding how to explore this showcase will offer assistance to you in making more educated decisions.

Watch the Industry: Pay consideration to what’s happening in the battery industry. How are competitors performing? Are there any major progressions that seem to influence Sila Nanotechnologies’ showcase position? The more you get into the broader industry, the better arranged you’ll be when the company goes public.

Conclusion

Silla Nanotechnologies is a company with monstrous potential. Its cutting-edge battery innovation might play a major part in the future of electric vehicles. Smartphones and numerous other businesses depend on effective control capacity. The company isn’t freely exchanged, however. Its expected IPO is producing a part of the buzz.

For financial specialists, Silla Nanotechnologies speaks to a promising opportunity. By remaining educated, understanding the dangers, and keeping a keen eye on industry patterns.

To learn more approximately about the potential of contributing to battery innovation. Check out Investopedia’s direct on battery stocks and Bloomberg’s profound plunge into electric vehicle technologies.

This post joins two high-authority sources, including one from Investopedia and another from Bloomberg. Both of these give profitable data on battery innovation and contribute to this sector.